What happened?

The IRS has received so many Employee Retention Credit (ERC) applications from scammers that they have been overrun with fraudulent submissions. To combat the deluge of illegitimate claims, they have “paused” the receipt of any further applications through the end of the year, effective September 14, 2023. This does NOT mean they have closed the program. It does mean they are not going to receive or process any new submissions during this time while they sort through the claims and eliminate the ones that are fraudulent. Once this work is completed, it should result in quicker processing times to get the checks in the hands of legitimate filers.

Any submissions already received by the IRS will continue to be processed. However, they are changing their target of a 90-day turnaround to one of 180 days. Any submissions already received will be given additional scrutiny to determine if they have a connection to the scammers or appear to be fraudulently filed. They may ask for additional information before finalizing the processing of the claim for the ERC refund.

For those filers who do not trust the company they used to file and wish to withdraw their filing, there will be procedures for that announced by the IRS later this year.

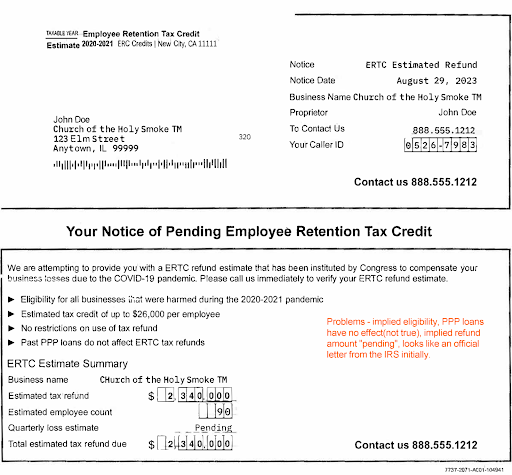

The IRS published schemes used by scammers to entice churches and business owners to file returns when they should have done more due diligence to determine if they were eligible. Those characteristics include:

- Unsolicited calls or advertisements mentioning an “easy application process.”

- Statements that the promoter or company can determine ERC eligibility within minutes.

- Large upfront fees to claim the credit.

- Fees based on a percentage of the refund amount of Employee Retention Credit claimed. This is a similar warning sign for average taxpayers, who should always avoid a tax preparer basing their fee on the size of the refund.

- Aggressive claims from the promoter that the business receiving the solicitation qualifies before any discussion of the group’s tax situation. In reality, the Employee Retention Credit is a complex credit that requires careful review before applying.

Here is an example of what one of the solicitations looked like. A ministry partner sent this to me, and I turned it over to their ERC Criminal Investigations Unit to investigate. You will notice some of the claims made by the author of the letter from the list above.

What does the IRS recommend?

“Work with a trusted tax professional. Eligible employers who need help claiming the credit should work with a trusted tax professional; the IRS urges people not to rely on the advice of those soliciting these credits. Promoters who are marketing this ultimately have a vested interest in making money; in many cases they are not looking out for the best interests of those applying.”

ACS Technologies has partnered with our firm to ensure their ministry partners have access to a trusted tax professional. James B. Jordan CPA, LLC is a member of the American Institute of Certified Public Accountants (AICPA). As such, we are bound by its professional ethics and to which we ascribe and adhere. For more information, please click here.

Frequently Asked Questions (FAQ’s)

- I have not filed or even started the process; should I wait?

- NO! That is the wrong approach. You should immediately engage a trusted tax professional and begin the process of applying. That way, you’re not in a rush to file when the IRS opens back up. We have seen it take two days to two weeks for churches to gather the information we need, and depending on your circumstances, it could take several weeks to determine your eligibility.

- Why the urgency to get our information to you? Two reasons.

- The filings are by mail only because they involve actual signatures; no electronic filing is available. You want to get yours in the mail the day they reopen, not start the process of preparing to file!

- The statute of limitations for being able to file for 2020 ends on April 15, 2024. Unless Congress acts to extend the statute of limitations, all returns not filed by that date for 2020 will become invalid and will not be processed. So, don’t lose out on the opportunity to file by delaying your analysis of eligibility, which we do at no charge.

- What do I do if I have already filed and want a second opinion? Contact us now! We offer all ACST ministry partners an analysis at no charge. We will offer our observations of your situation and discuss what your options are.

James B. Jordan, CPA is the proprietor of James B. Jordan CPA, LLC, a nationwide full-service CPA firm that exclusively focuses on churches and specializes in ERC services. He has been a frequent speaker at ACS Technologies conferences, teaches financial management for clergy at Emory’s Candler School of Theology, and is the author of Financial Management for Episcopal Parishes.